*This article was initially posted on Livewire

While some developed countries have already kicked the habit, Australia still uses coal to generate the vast majority of its power. But things are about to change quickly. Our coal-fired stations are heading for retirement, and renewables present better economics.

This creates a $170 billion investment opportunity and one global organisation that has its arms all over this is Octopus Investments. To find out more, I interviewed Managing Director, Sam Reynolds. To hear about the inevitable shift to renewables, and how you can invest in it directly, read on for Sam’s responses.

Sam, Could you give a short description of Octopus?

First established in 2000, Octopus’s founders, Chris, Simon and Guy, have always looked at financial services differently, focusing on markets that are outdated and in need of change, where we can share in better outcomes for customers and their communities.

While the global business invests across a number of sectors including property, ventures and healthcare, we are best known for our renewable energy capabilities. We’ll be leveraging our track record in Australia to create reliable clean energy for all Australians.

This is really exciting for us, as we are passionate about instigating change and building a clean energy future. The opportunity to fundamentally transform an energy market traditionally reliant on fossil fuels, and bring about a more sustainable future for energy customers, is one of the key drivers behind why Octopus is building its offices in Australia.

So, where did the name ‘Octopus’ come from?

The origin of the name came from a friend of the Founders that described an animal that is not pretty with a bulbous head, three hearts, has been observed using tools, is clever, flexible, shoots ink to deter predators, can change colour depending on their environment and can squeeze into (or out of) tight spaces. That animal is an Octopus and the advice to the Founders was that is your new company name!

What do you like to do when you are not at work?

My time is spent with family, friends and playing sport. I grew up in QLD and loved the beach, have lived at places like Bondi Beach and Esperance (WA) and spent 12 months working on a 4-million-acre cattle station in the NT, so you could say I like the outdoors…. Having recently moved back to Australia in 2018 after a 15-year stint in London and Edinburgh, getting out and about again is pretty special. I have even dusted off my old ironman ski, which I kept in my Aunty and Uncle’s shed after initially saying I would be back to collect it after a 2-year working holiday.

What is the firm’s track record and what would you say is your competitive advantage?

Octopus manages $5.1bn in energy assets across 250 projects for institutional, wholesale and retail customers. Few others can boast of such an extensive track record in helping energy markets transition from fossil fuels to renewable energy. Octopus’s portfolio spans the UK, France, the Nordics and Italy. We are the largest investor into European solar and the largest non-utility investor into onshore wind in the UK.

Octopus has brought those skills and experience to the Australian renewables market to source and structure sound investments and implement best-in-class operations.

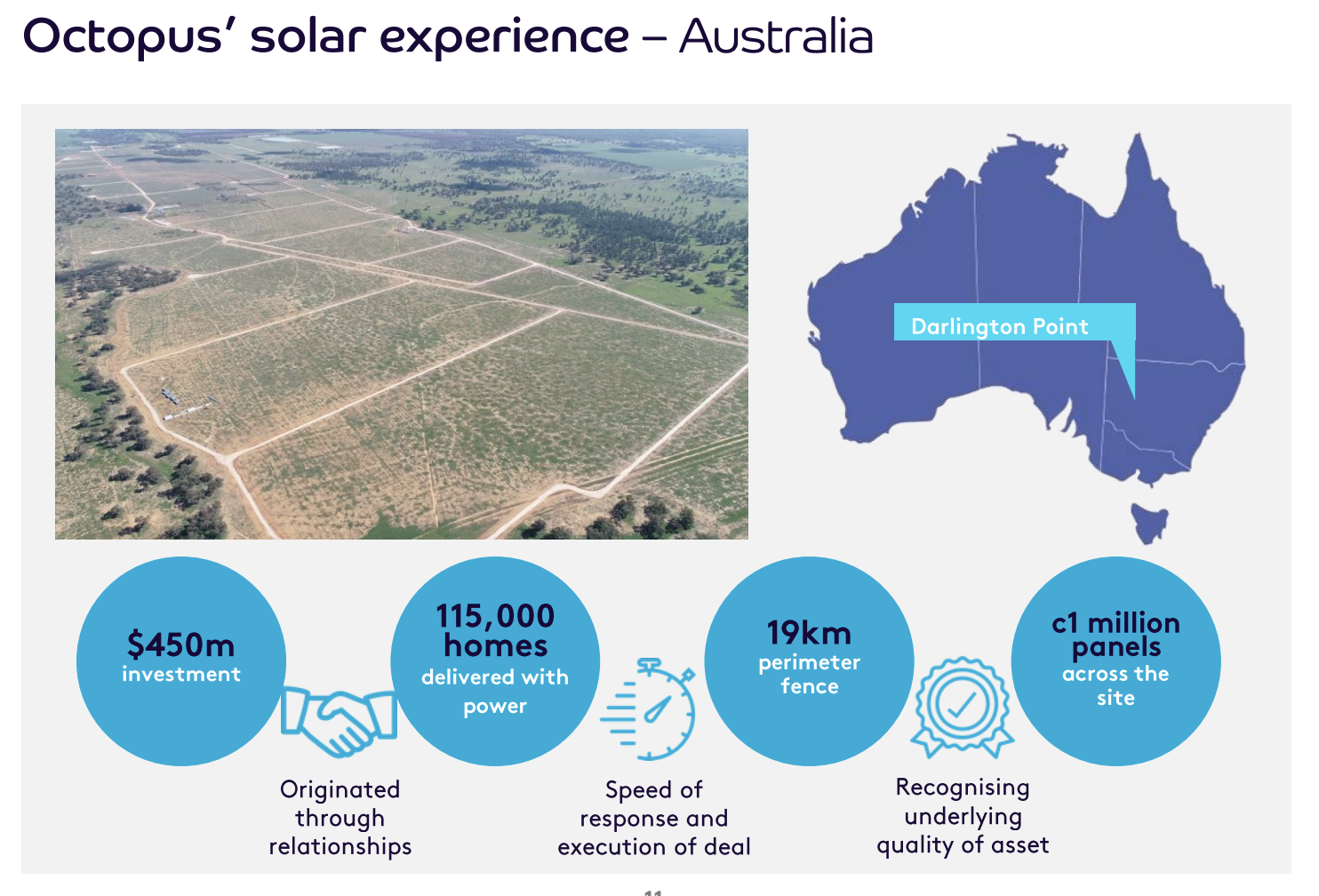

To demonstrate our commitment to the Australian market, firstly Octopus has made its debut investment in Australia in the country’s largest solar site, the $450m Darlington Point, which will generate enough power to supply over 5% of NSW households.

Secondly, we have invested in a large and experienced Australian team. Given the challenges of the domestic market, we believe it is necessary to have a sizable internal investment, legal and engineering team with experience spanning both European and Australian energy markets. We have a specialist team of 12 across Melbourne and Sydney, making us one of the largest specialist renewables owner-operator fund managers in Australia.

In addition, what truly sets us apart, is the ability to call upon our dedicated team of 70 renewable energy professionals in Europe, who can bring to bear the experience of operating one of Europe’s largest portfolios.

What stage is Australia at in its shift to renewables?

Australia is known to be one of the country’s most reliant on coal and has taken its time to embrace renewable energy. To put this in context, last year, 80% of Australia’s energy was sourced from coal and gas. In contrast, by 2025, the UK will stop using coal as a source of electricity.

We believe this illustrates where Australia is headed: renewables are coming to Australia and it’s not a question of if, but when, the change will happen for Australia.

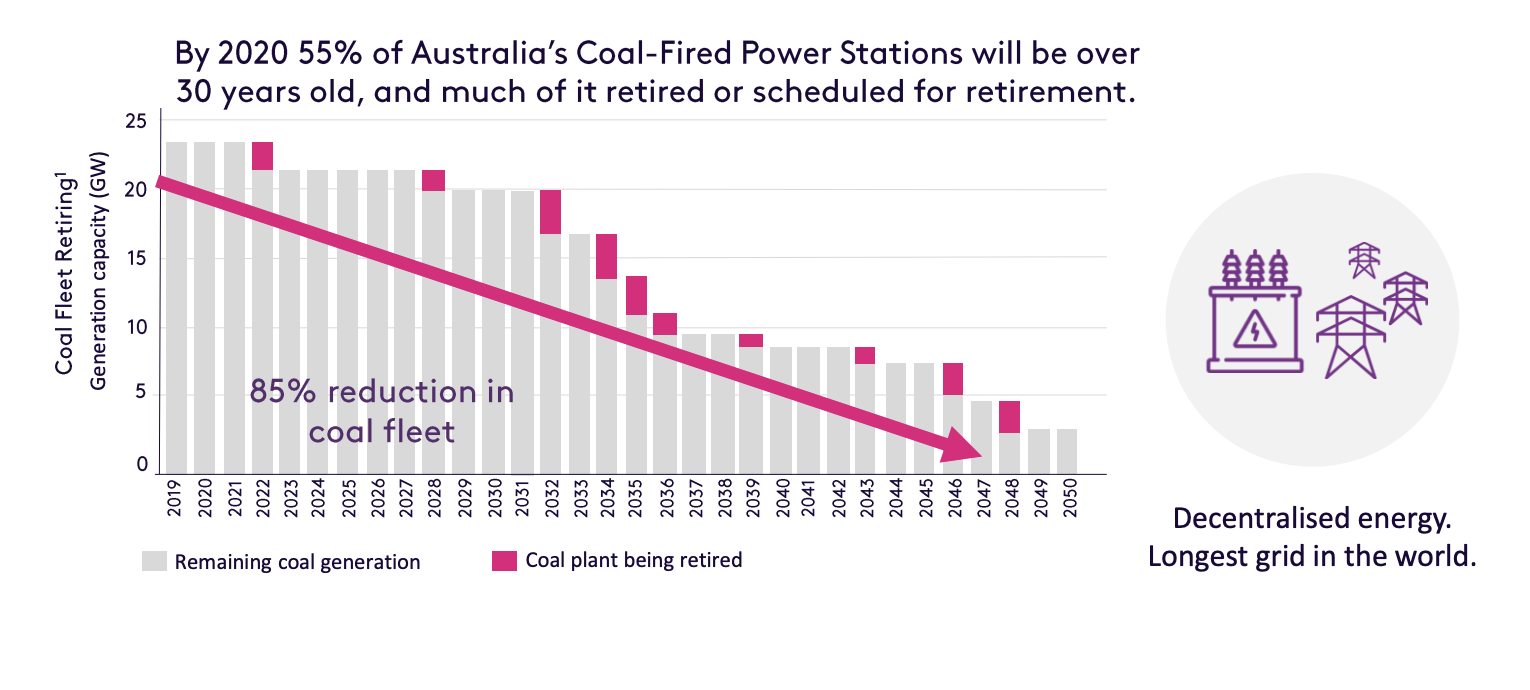

To further exacerbate the domestic situation, by 2020, 55% of Australia’s coal-fired power stations will be over 30 years old, and much of it will be either retired or scheduled for retirements.

In the next 10-30 years, 85% of the country’s coal-fired powered stations are forecast to retire, not just because of the environmental impact but because it is not economically viable to reinvest in this technology.

This highlights the constraints in energy supply that will occur in Australia. This is occurring in tandem to the robust demand for energy in the future. It is predicted that there will be a need for $170 billion in new energy investments, hence, at Octopus, we believe this creates an incredible investment opportunity for investors to partner with the right experienced team.

What are your best-case and worst-case projections of how long it could take Australia to get to 50%, and how come?

We believe, given the dynamics occurring within the energy market in Australia, as described above, we see a migration to renewable energy of the order of 50% occurring around 2030 – 2032.

It is also worth noting that we are likely to observe the coal fleet retiring at a more aggressive rate than forecast, similar to what was observed in the UK and Europe. As coal power stations break down, given the economically unviable nature, they are likely to face premature retirements beyond what is forecast.

This essentially means, whilst we believe we are likely to be at 50% renewables by 2032, it is realistic that this transition occurs sooner than that given renewable energy is currently the most economically viable source of energy production.

What have been some of the firm’s most successful investments?

Just to name a few that come to mind;

‘Project Cornerstone’ – Octopus financed the single largest build-out ever of solar in the UK in 2014-15. Overseeing the deployment of c$800m across 25 large scale solar assets within 5 months. This was financed by one of our flagship wholesale funds and was a great result for investors realising c.15% returns. The process was a testament to the large team Octopus have dedicated specifically to renewables and their capabilities

‘Octopus Energy’ – Octopus Energy, our energy retailing business, represents the core values of the firm: where markets are not delivering for customers there’s an opportunity to build a brand people love. From a standing start in 2016, Octopus Energy now has 5% of the UK retail supply market and has the highest NPS/customer value score of any supplier in the market.

OE is now licensing this technology to some of the world’s largest energy companies, including Europe’s EON as well as with Korean multinational Hanwha Australia for their retailing businesses.

What is the opportunity here for Australian investors and where do you see your investments fitting into a portfolio?

With a large amount of the coal fleet scheduled to retire, there will be a contraction of electricity in a country that has one of the fastest-growing populations of the developing world, experiencing record heatwaves and calls for cleaner energy from consumers and investors. Solar and wind technology offer some of the most affordable forms of energy generation, and will be part of Australia’s energy mix, as we have seen in other countries across the world.

We believe the primary opportunity is simple, an investment that brings attractive risk-adjusted returns and also provides a direct opportunity to be part of Australia’s clean energy future.

An investment in renewables also offers several portfolio enhancing characteristics, primarily around the diversification benefits; both within a total portfolio context but also within the infrastructure sector more broadly. Given its unique characteristics, these investments are lowly correlated to more traditional asset classes.

Lastly, they can be more defensive in nature, as they are able to obtain cash flows once operational, regardless of market sentiment.

We expanded on the benefits in investing in renewables in more detail in this recent wire here.

Could the fallout from COVID-19 affect you – either negatively or positively? If so, in what ways?

“Never waste a crisis” was a quote attributed to then-President-elect Obama’s chief of staff as the new president was about to be sworn in at the height of the Global Financial Crisis. That is to say: we don’t yet know how hard this crisis is going to be, but there is a sense that beyond the current events lies significant opportunity.

For Octopus that opportunity is the chance to demonstrate in real-time how resilient renewable energy assets are in the face of shocks to the economy and rarely precented volatility.

Operational assets are remarkably stable due to the following:

- The fuel source (the sun and wind) aren’t impacted by market forces nor dependent on the resilience of global supply chains.

- Day to day operations of sites involve few moving parts or need for onsite workers.

- Value of a site is driven by a mix of contracted revenues with retailers/corporates/governments as well as long term fundamentals of the energy market which in Australia are quite compelling.

Could you outline what ESIC2 is seeking to achieve?

Alongside our institutional fund offering, Octopus ESIC2 is our wholesale investment strategy, that comes with a number of tax benefits, while providing an opportunity to invest in one or more ‘shovel-ready’ solar projects. Shovel ready means that all construction and operational contracts are finalised, and contractors are ready to commence work on site.

The company will take the project through its 6-to-12-month construction programme through to steady-state, cash-generating operations. Value to shareholders will be driven by the de-risking of the site post-construction, selling the site’s energy generation during operation phase, and then realising the project via a sale at the end of the two-year term. The sale more than likely being to a local or international institutional investor, as we have done many times in Europe.

The company will qualify as an Early Stage Innovation Company and obtain a Private Binding Ruling from the ATO, which will be confirmed before investor funds are called upon. The ESIC legislation allows for investors in qualifying companies to claim two tax incentives:

- A 20% tax offset on the amount invested, capped at $200k per income year per investor. That being a $1m investment, receives a $200k benefit.

- The investment is free of capital gains tax if held for a period longer than 12 months and less than 10 years.

What excites you most about your role?

Firstly, I get to work with some fantastic people. Renewable Energy is a sector that has a wide appeal due to its positive impact on the environment and the greater community, which means we are lucky enough to be able to retain and recruit some amazing people.

Octopus people are a little different, yes you have to be competent whether in an investment role or an engineering role, but you also have to have the right mix of entrepreneurial spirit, and generally be a good person to sit next to at a dinner party.

Some firms struggle when considering society or the local community as part of the investment process, it is generally a bridge too far for an investment professional to change their spots, seek sustainable long-term returns all whilst keeping an eye on your environment. My team naturally thrive on this stuff and they are already passionate about the positive impact they are having by the investments we are making.

Secondly, I can come to work every day and I am able to challenge the way things have been done in the past. In Australia, that means thinking differently about how energy is deployed, operated and monetised, while delivering a great investor experience.

Yes, renewable energy builds a better cleaner and safer future for our children but investing into renewable energy should not be done on the green benefits alone if void of investment merit. It has to stand up to sound financial rigour as any industry should, for it to gain traction with investors.

Octopus has proven this is a really successful approach; we’ve grown to be the number 1 investor in Europe in less than 8 years. We’ve offered investors clean energy investments that have delivered attractive returns because of the approach we’ve taken, and now with a team of 12 in Melbourne and Sydney, we’ll do the same in Australia.

Can you share a book, documentary, or report that you have read/watched recently on the thematic?

Embarrassingly I don’t read a lot of books specifically on renewable energy, most of the books I read at night and not chosen by me but by my 18-month-old daughter!

My focus now in my position is around being a better manager and getting the best out of people. Understanding what makes different people tick, then deciding how best to motivate and communicate with them – this part of my role is both exciting and challenging. So that’s what I like to read about or listen to.

I have also been a late starter to Podcasts but really enjoy interviews with some of the most successful business and sporting people in the world and understanding how there are so many similarities in their roads to success.

My favourite Podcasts at the moment: How I built this (interviews with entrepreneurs), The Howie Games (awesome sports personality interviews), and obviously, Livewires’ ‘The Rules of Investing’!

How can investors find out more about Octopus?

Octopus Investments invests directly into the Australian renewable energy sector and helping to provide the innovative solutions it needs during its transition to a clean energy future. Octopus intend to be a leader in driving Australia towards a cleaner future. Stay up to date with Sam’s latest insights by clicking follow below here or visit their website for more information.