Octopus Australia, the specialist renewable energy developer and fund manager, is today announcing a new commitment from Rest, one of Australia’s largest profit-to-member superannuation funds. This comes as it successfully closes the second round of fundraising for its flagship renewable energy fund, the Octopus Australia Sustainable Investments Fund (OASIS).

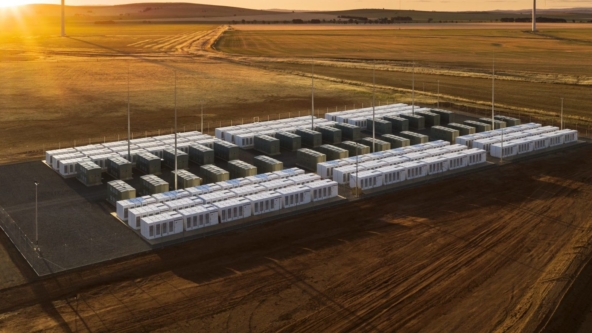

OASIS provides local and international institutional investors with exposure to Australia’s renewable energy transition. The fund invests in assets across wind, solar and storage from development through to construction and operations.

Rest is a A$75bn super fund with more than 1.9 million members, including more than a million members aged 30 or younger. In addition to this commitment, existing cornerstone investors in OASIS, including Hostplus, the CEFC and Sky Renewables, followed on from their first round with an additional A$200m. This brings the total funds raised by Octopus Australia across its renewables platform to A$550m in just over 12 months since inception.

With this second close milestone, Octopus Australia now manages A$1bn in operating and construction assets, A$4.2bn of projects under development and a further A$1.3bn under exclusivity.

So far this year, Octopus Australia has secured development rights to the 400MW Hay Plains wind farm in New South Wales and with this acquisition, Octopus Australia now has wind assets secured in Australia’s three largest energy markets:

- Queensland (180MW Dulacca Wind Farm – operational (70% contracted)

- Victoria (400MW Giffard Wind Farm – development)

- New South Wales (400MW Hay Plains Wind Farm – development)

Sam Reynolds, Managing Director of Octopus Australia, commented:

“The Australian energy market is making important strides towards securing a sustainable, renewables-led future. Institutional investors are playing an essential role in driving change.

“We’re thrilled that Rest has placed its trust in Octopus Australia to support the energy transition on behalf of its members, generating both renewable energy and financial returns. We’re equally delighted to have secured the ongoing support of our existing cornerstone investors, who have been valuable partners in the fund’s success to date. We now look forward to both deploying commitments into essential projects across Australia, while also turning our attention to another raise towards the end of 2023.”

Andrew Lill, Rest Chief Investment Officer, commented:

“Rest represents more than a million members aged 30 or younger who will retire after the year 2050. We have strong conviction that responsible investing adds value.

“OASIS is expected to enhance our members’ long-term financial interests and help shape Australia’s energy transition through a pipeline of solar, wind and storage infrastructure projects.

“This investment will also contribute to Rest’s objective to achieve a net zero carbon footprint for the fund by 2050 and is a welcome continuation of our plan to increase our allocation to climate-related solutions. “As a long-term supporter of Australian infrastructure assets, particularly in the renewable energy sector, I’m pleased our members will benefit from additional investments in this area.”

About Octopus Australia

Octopus Australia is a specialist renewable energy developer and fund manager in Australia. Octopus Australia has team of 40 professionals in Melbourne (HQ) and Sydney, have an operating portfolio of $1.5bn and a development portfolio of $8bn across wind, solar and storage (large batteries). Our active approach means we are much more than just a financial investor, with a team that has a unique blend of skills and expertise across all facets of the renewable energy market, including investment, development, energy markets (data & analytics), grid and engineering, asset management, and community engagement.

About Rest

Established in 1988, Rest is one of Australia’s largest profit-to-member superannuation funds, with more than 1.95 million members and around $75 billion in funds under management as of 30 June 2023.