Octopus Australia’s suite of renewable funds have received ‘Recommended’ ratings from Zenith Investment Partners1, a leading research house and the number 1 rated research house on the Relationship Strength Index by Peter Lee and Associates.

Octopus Australia (OA), the specialist renewable energy developer and fund manager, has two funds, Octopus Australia Sustainable Investments (OASIS) and Octopus Australia Renewable Opportunities (OREO). OASIS provides investors with exposure to a diversified portfolio of Australian clean energy infrastructure assets through its investment in development, construction and operational renewable energy projects and is backed by CEFC (Australian Government fund), together with Hostplus and REST superannuation funds. OASIS is open to both institutional and sophisticated (wholesale) investors. OASIS targets a return of 10-12% p.a. net of fees, pre-tax. OREO offers a similar portfolio of construction and operational renewable energy projects, and targets a 4-5% annual yield.

Zenith’s report commented: “Zenith considers the Funds an attractive and highly differentiated offering owing to OA’s extensive experience in energy markets and the detailed and intuitive investment process. The Fund may appeal to investors seeking exposure to a vehicle aiming to achieve a positive environmental outcome alongside attractive investment returns”.

Zenith initiates coverage of the Funds at a Recommended rating. In addition, Zenith has assigned a Responsible Investment Classification of Impact.

Sam Reynolds, Managing Director, Octopus Australia, commented: “I’m delighted to have Zenith, a premier research firm, recognise our funds and assign both a recommended rating. This is the first rating Zenith have provided for a renewable energy fund and is a significant milestone for our business, and justification of both our strategy and the strong team we have built”.

About Octopus Australia

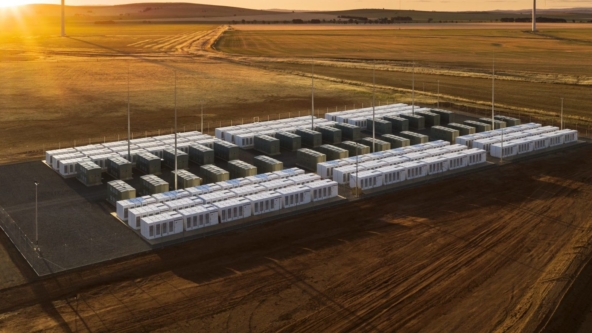

Octopus Australia is an Energy Infrastructure and Technology business with a strong focus on creating Change. We have been investing into renewable energy around the world since 2010 and in Australia since 2018. We take a data & technology approach to constructing our energy portfolio that looks like the future of energy. One which includes, Wind, Solar, Storage (large batteries) and in time Hydrogen. Change. is why you want to work with Octopus Australia and incorporates our team’s culture, our community programs and also our indigenous joint venture Desert Springs Octopus. Octopus Australia has $1.1billion in assets in Australia and a development portfolio of $8.8billion. Our team includes 45 dedicated renewable energy professionals located in Melbourne, Sydney and Auckland.

1The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (APIR PLT0852AU and OOM4081AU assigned December 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines